investment outlook 2025

inVESTMENT OUTLOOK 2025

In this report

Past performance should not be taken as a guide to future performance. The value of investments, and the income from them, can fall as well as rise and you may not get back what you put in. You should continue to hold cash for your short-term needs.

-

1 Lorem ipsumdolo

Reflecting on 2024 – a year of resilience and strategic adjustment

![]()

Resilient global economy

The global economy demonstrated resilience in 2024, recovering from the volatility and uncertainties of the previous year. Global growth remained steady, avoiding the recession many incorrectly feared towards the start of the year. By contrast, our investment process focused on the robust health of US corporate earnings and associated strong consumer spending, compelling us to remain positioned in risk assets, such as equities and high yield bonds, for much of 2024. This has materially benefitted portfolio and fund performance.

Although the pace of the expansion is now starting to slow, it is still positive in the US where job creation and solid household finances continued to sustain spending levels despite higher interest rates. This strength has helped cushion the economy against potential downturns, even as tighter financial conditions weighed on specific sectors like housing and construction.

Interest rate cuts

Central banks, notably the US Federal Reserve (Fed), initiated interest rate cuts in the latter half of 2024 as inflation continued to fall; now down markedly from its heady levels in late 2022. With inflation diminishing, down to 2.4% for the year to September, rate cuts were more aimed to stabilise economic growth, and were crucial in restoring market confidence against early signs of a softening labour market. As a result, markets responded with equal stability, particularly in sectors like technology and consumer goods, which historically have tended to be more sensitive to changes in consumer spending.

The US election: a pivotal factor for markets

In November, Republican representative Donald Trump won the 2024 presidential election along with Republicans also winning the majority of seats in Congress. This will make it easier for Trump to action legislation such as tax reforms, deregulation plans and shifts on trade policies which will all be of interest for international trade and investors.

However, historical trends suggest that longer-term market performance is driven more by productivity gains and effective monetary policy than by political shifts. We remain cautious but adaptive, through portfolio diversifiers such as our liquid alternatives position. Therefore we are optimally placed to manage any risks associated with these developments.

Anticipating the UK Budget: balancing inflation and growth

As the UK integrates the decisions from the Labour government’s Autumn Budget announcement, markets are closely monitoring fiscal policies designed to stabilise public finances while managing any up-side impact on inflation. Expectations centre around measures that address rising debt levels and associated costs, while also providing targeted support for sectors like infrastructure, housing, and green energy. Some further market volatility could be expected as policies are debated and rolled out, but clarity in fiscal strategy should help stabilise UK sentiment. Investors are particularly interested in how these measures will impact finance and real estate sectors, which are more sensitive to fiscal policy shifts.

Inflation moderation and central bank actions

Throughout 2024, global inflation pressures eased, with rates trending downward. This allowed major central banks to pivot from aggressive tightening policies to more supportive rate cuts aimed at maintaining growth. While inflation in goods sectors saw significant relief, the services sector continues to face ‘sticky’ price pressures, which central banks are monitoring closely. Policymakers are expected to balance these dynamics carefully to avoid destabilising the economic recovery while managing inflation expectations – the quintessential ‘soft landing’ where a recession is avoided. The expectation is that ongoing vigilance and strategic interventions will be necessary to guide the global economy towards price stability without stifling growth.

![]()

Navigating 2025: balancing opportunities and risks

Looking ahead, the global economic outlook for 2025 is characterised by a balance of opportunities and potential risks. Growth is expected to stabilise but remain below pre-pandemic levels, particularly as advanced economies face the challenge of managing inflation while fostering growth. Emerging markets have the potential to revert from their recent lacklustre growth to once again be global economic contributors, especially in regions investing heavily in technology and infrastructure.

However, geopolitical risks, including the ongoing dynamics between the US and China, will continue to influence global trade and market sentiment. Trump’s Presidential victory indicates a strategic pivot towards domestic policies that may alter international trade relationships. For investors, this means staying agile and diversified, especially across growth opportunities despite broader market uncertainties.

To navigate this complex landscape, understanding the nuanced impacts of fiscal and monetary policy shifts on the major asset classes such as equities and bonds, as well as sector-specific trends, will be critical. -

2 Lorem ipsumdolo

Interest rate cutting environment

![]()

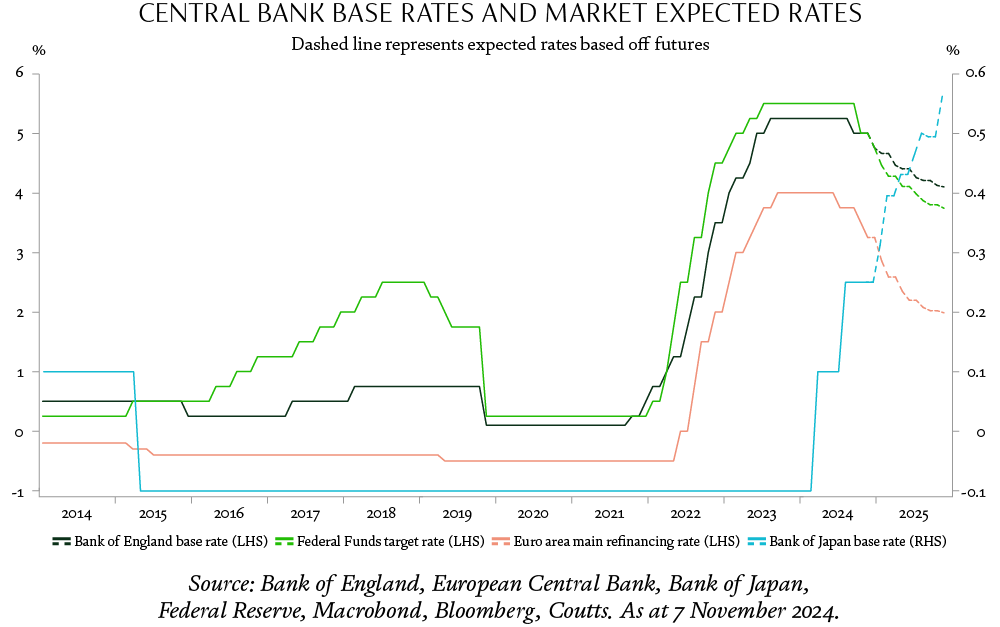

After a couple of tumultuous years that saw inflation reach record high levels across developed economies, causing the steepest rate hiking cycle in the past 40 years, things have remarkably normalised during 2024 with that process expected to continue and largely complete in 2025.

Solid economic backdrop

With core inflation still above targets but firmly back on a 2% trajectory and signs of a loosening of the labour market, Central banks have started reversing some of the hikes delivered between 2022 and 2023 with several more cuts expected to take place in 2025. The Bank of England has cut interest rates by 0.5% while the Fed and European Central Bank both lowered rates by 0.75%. At the time of writing, these three central banks are expected to deliver between two and five extra rate cuts by July next year, bringing interest rates closer to their estimated terminal rate.

![]()

![Yield for different levels of risk]()

Against the odds

Defying most expectations, this normalisation process has so far happened with little economic pain – US growth remains resilient, supported by strong consumer spending and easy fiscal conditions. In particular, the number of job creations in the US has been positive, keeping employment levels stable and with it the economy growing. As a result, and despite some ongoing weakness across rate sensitive parts of the US economy, recession fears have largely receded in recent months.

![Yield for different levels of risk]()

Against the odds

Defying most expectations, this normalisation process has so far happened with little economic pain – US growth remains resilient, supported by strong consumer spending and easy fiscal conditions. In particular, the number of job creations in the US has been positive, keeping employment levels stable and with it the economy growing. As a result, and despite some ongoing weakness across rate sensitive parts of the US economy, recession fears have largely receded in recent months.

![]()

Japan remains an outlier

While the inflationary and rate backdrop is pretty similar across most G7 countries, Japan has been standing out among its developed counterparts. The Bank of Japan (BoJ) remained on hold during the global rate hiking cycle in 2022-2023, only rising this year as central banks embarked on rate cuts. Underlying inflationary dynamics in Japan mean we are likely to see the BoJ remain an outlier during 2025, diverging from a global trend towards lower interest rates.

GROW and PRESERVE YOUR WEALTH

Learn more about investments, what our experts think and marketing investment offers available from us.

-

3 Lorem ipsumdolo

US earnings – broadening growth

![]()

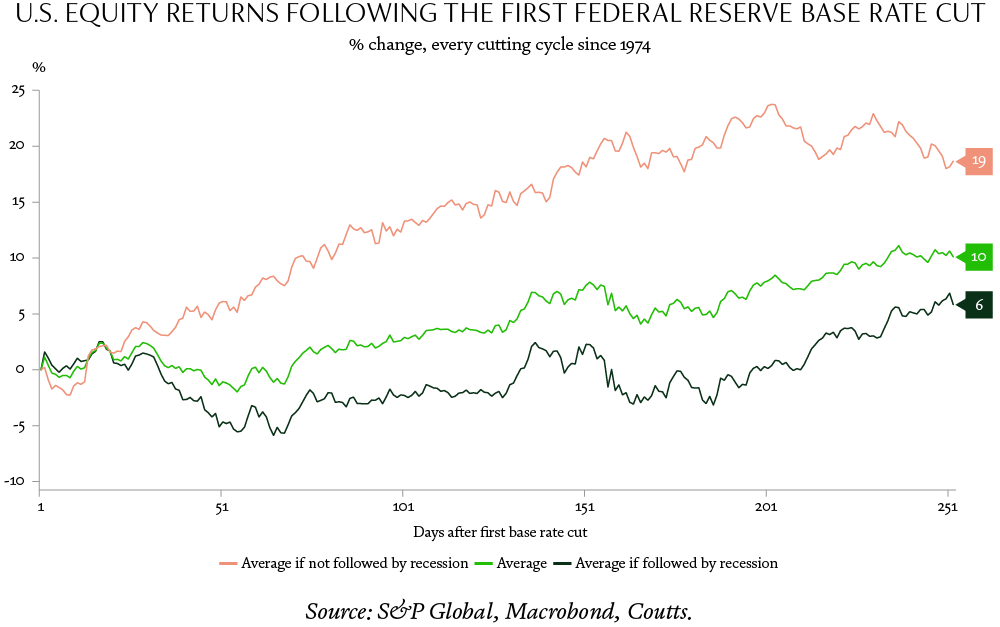

History isn’t repeating itself

Looking at previous rate cutting cycles by the Fed in detail, patterns begin to emerge. Since 1974, seven out of nine of the previous rate cutting cycles by the Fed have coincided with a US recession – where the economy contracts for two or more consecutive quarters. Markets had on average been weak, falling by more than 10% from their recent highs before the Fed started cutting rates – this includes in 2001 following the dot com bubble and in 2007, just before the Global Financial Crisis. Therefore, it is not surprising to see that equities on average perform poorly during these periods.

This makes this rate cutting cycle differ from past cycles. Central banks have historically started cutting interest rates in reaction to a rapid deterioration in the economic activity and labour market, however that is not the situation we are seeing.

Should a recession be avoided this time around, as we believe it will, rising corporate earnings and continued consumer strength should allow markets to continue performing despite elevated valuations. This has had, and will continue to have, implications for markets given that the strength of the economy is what really determines whether rate cuts benefit equity markets.

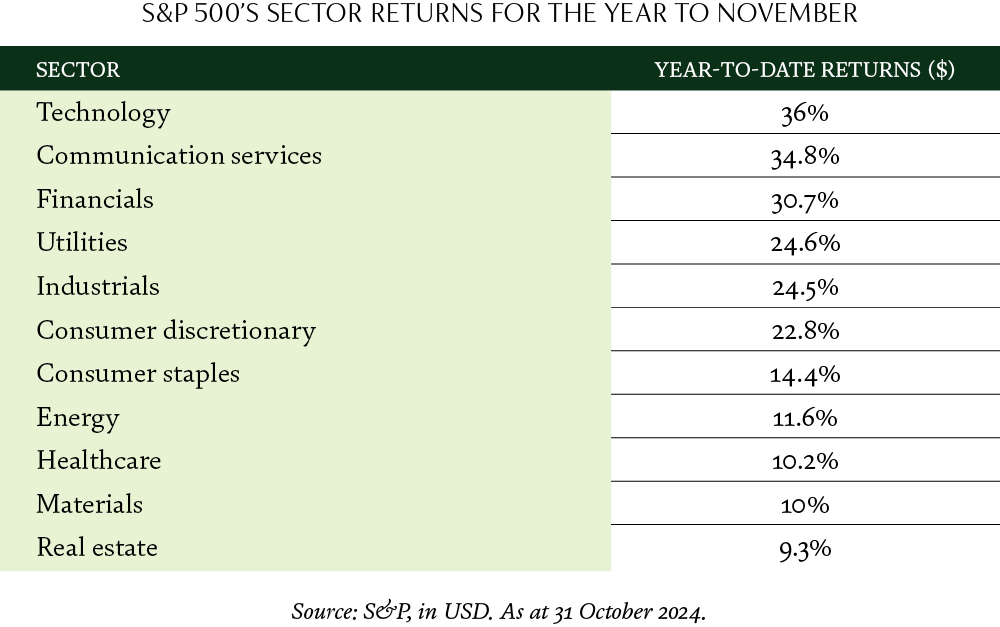

Accelerating growth

This time, as they say, is different. Rather than decelerating, US earnings growth is expected to accelerate to 14% in 2025 from around 9% in 2024. Furthermore, US equities are at all-time highs. As a result, we cannot rely on past market reactions to interest rate cuts as a reliable guide for what will likely happen in 2025.

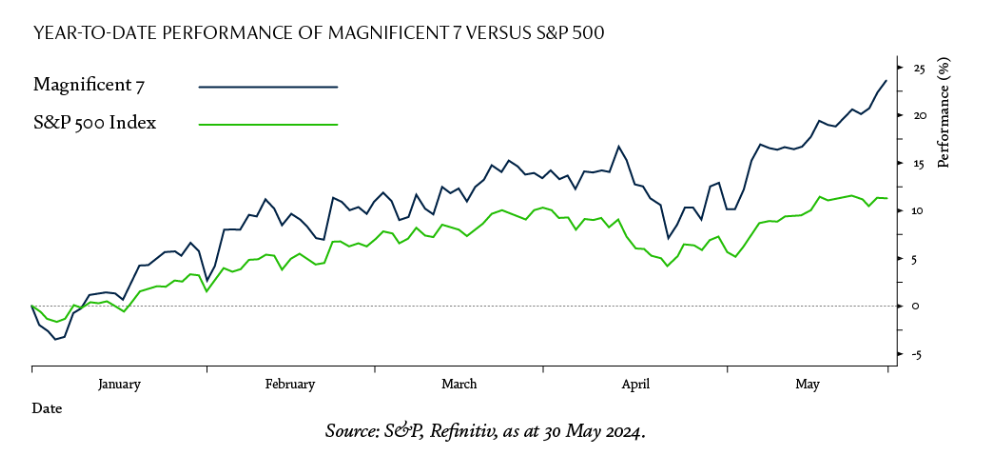

Looking at earnings, we are seeing a broadening out of earnings growth across the market. For the early part of 2024, the vast majority of US earnings growth was being driven by a handful of technology and internet companies, the so-called ‘Magnificent 7’ compiled of Amazon, Apple, Alphabet, Microsoft, Meta, Nvidia and Tesla. Since then, the proportion of companies delivering positive earnings has continued to climb while growth from the Magnificent 7 has declined.This has contributed to the market rotation that we have seen away from these mega-cap technology giants since July. This is the result of their reduced relative appeal in an environment where lower interest rates are boosting the outlook in more cyclical sectors. We view this broadening out of earnings growth and performance as healthy for future equity returns.

![]()

-

4 Lorem ipsumdolo

Our Asset Allocation

![]()

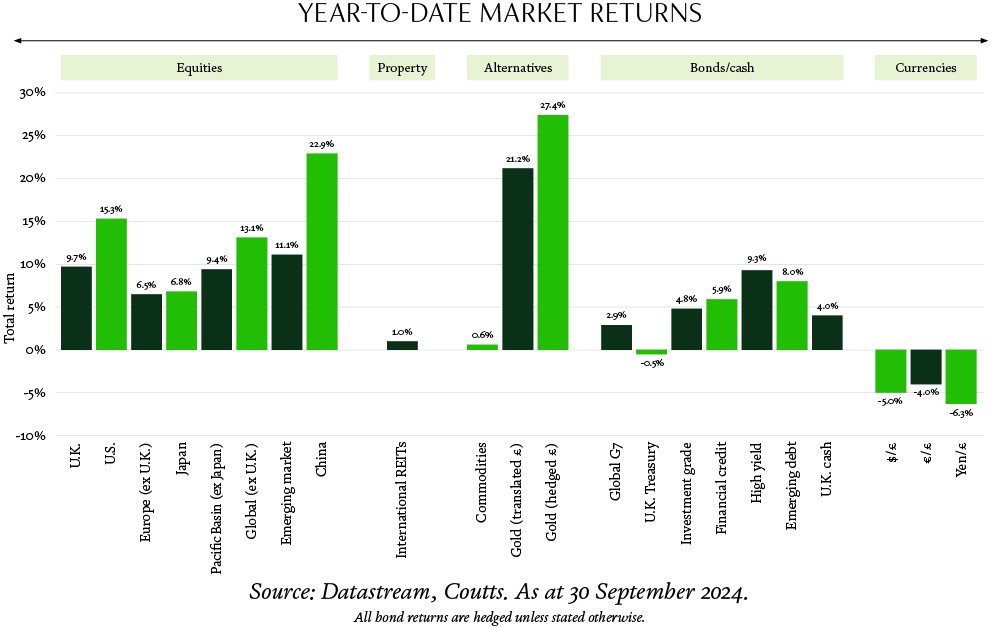

Good year for multi-asset portfolios

Stock markets have performed well over the course of the year as the global economy and corporate earnings have maintained solid growth.

In parallel, worldwide inflation has declined to more comfortable levels, leading to interest rate cuts which should persist into 2025. As a result, both government and corporate bonds continue to earn their yield.

![Yield for different levels of risk]()

Leaning into risk

Our funds and portfolios have benefitted additionally from leaning into ‘risky’ assets – equities and high yield bonds – and holding a diversifying position in gold. As the economic backdrop shifted, we took profits on both the high yield and gold allocations.

During the summer, we made a strategic shift in our equity allocation to global equities, which will provide us with access to growing opportunities worldwide.

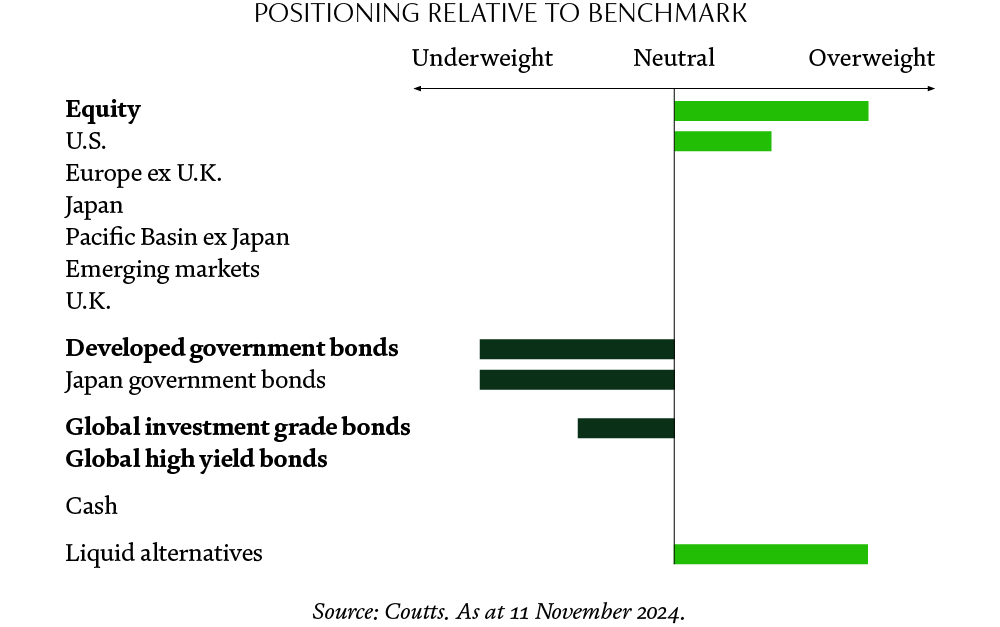

Portfolio Positioning

2025 will be characterised by moderating but positive economic growth and declining interest rates in most major developed economies.

Against this backdrop, our portfolios are positioned to lean into the positive outcomes of the business cycle while earning still-attractive bond yields.

Equity – Our investments continue to be weighted toward risky assets, specifically global equities, and more specifically via a blend of two active fund managers with good track records of picking high quality, multinational companies with strong profit-making potential.

Fixed income – Within the bond space, we lean away from Japanese government bonds as it is the one region where inflation and interest rates are rising rather than falling.

Although inflation has fallen to target levels, the evidence of continued consumer resilience suggests that we should not become overly complacent about the risks. We introduced a fund that uses ‘liquid alternative’ strategies to provide portfolio ballast should the defensive nature of bonds weaken. These are essentially a set of investment strategies with daily pricing which demonstrate low correlation with stocks and bonds.

The table shows our positioning, across various regions and asset classes, relative to our benchmark. This includes whether we are underweight, neutral or overweight.

This time last year, investors saw doom and gloom on the horizon for 2024. Markets expected eight rate cuts by the Fed, heightened recession risks and underwhelming performance. Although this year will likely be more bullish, such prognostications are likely to be as useful as last year’s.

![]()

Positioning relative to benchmark

The table below shows our positioning, across various regions and asset classes, relative to our benchmark. This includes whether we are underweight, neutral or overweight.

![Untitled design - 1 Yield for different levels of risk]()

At this time last year, 2024 expectations were largely for doom and gloom, eight rate cuts by the Fed, recession, and limp market performance. Although this year will likely be much more bullish, but such prognostications are likely to be as useful as last year’s.

![]()

Winter is coming

Our investment process is constructed using two strategies: Anchor and Cycle. Anchor focuses more on the long term, getting our over-arching positioning right for the next five years or longer. Cycle on the other hand focuses more on the present and where we are in the business cycle today.

As we turn into winter, we too are bullish. Our Cycle process suggests slowing – but growing – economies, consumers still experiencing real wage increases, and diminishing monetary gravity (lower global rates and increased Chinese liquidity). This is good for earnings. Our Anchor process is far less bullish, and valuations are expensive for risk assets; but they were a year ago too, and valuations are famously not a timing tool.

Nonetheless, we recognise we have no crystal ball but can be mindful of the potential risks that could develop. To us, the key risks that we can see are twofold:

- Inflation makes a comeback. This could cause central banks to halt current loosening. Services inflation remain uncomfortably high, and hindsight could judge that cutting rates was premature.

- Recession is not impossible. JP Morgan’s global manufacturing PMI – a leading recession indicator – is at levels suggesting recession. The “Sahm Rule” – also a historically accurate indicator of recession – was triggered earlier this year. Given the peculiarities of this post-pandemic recovery (which is still affecting data years later), these indicators have been less effective than usual – but that is not to say they are incorrect.

Other risks exist too: rising oil prices; tariffs under a Trump presidency and China’s balance sheet recession not receiving enough fiscal remedy could all have implications on market performance.

While we are risk-on, we remain cognisant of risk. Therefore, our investment process is designed to address the potential outcomes of these scenarios should any of these risks come to fruition.

LOOKING TO INVEST?

Learn more about investments, what our experts think and marketing investment offers available from us.

The above article has been written and published by Coutts Crown Dependencies investment provider, Coutts.

More insights